A wealth of knowledge on BFSI

Our research says:

To compete effectively in today’s digital world, disruptive changes in technologies combined with social, economic & geo-political forces are driving banks to transform.

>70% of banks in developed economies & >60% in emerging markets have begun implementing digital transformations

We analyzed this data through our 3 dimensions of Products & Services, Business operating models and Business Processes. Our analysis indicated that banks need to focus on 3 major areas to transform into a digital bank:

Being life enabling (Being customer centric & not product centric)

Being Omnipresent (available anywhere, anytime)

Being intelligent / a thinking bank (effective use of data)

Banks are seeing the need to invest in customisation & empowerment:

- Tailoring customer experience through products, adapted to customer needs

- Investing in recent modes of contact like virtual agents, web chats

- Using Predictive analytics to develop insights into customer behavior and preferences, for personalizing services

- Offering Self-help, screen share to savvy customers

Some innovative solutions for a better customer experience include:

- Move from a multichannel to an Omni channel approach

- Create Digital Self Service Branches

- Employ innovative Payment and Mobile Point of Sale Solutions

- Implement Visual IVR and Virtual Agent Solution for faster Transaction processing

The Tech Mahindra BPS edge:

To address the above needs of banks, Tech Mahindra BPS has invested heavily in building unique and high-value Digital Enterprise Solutions to help bank transform their business processes.

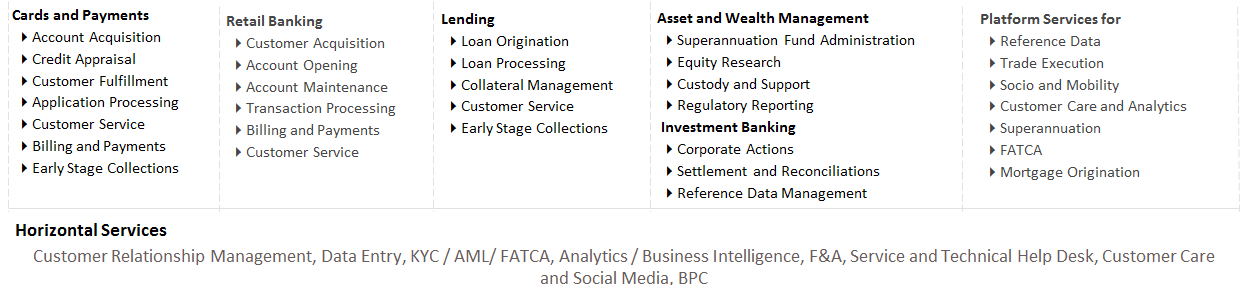

Our end-to-end service offerings cover the entire BFSI spectrum, supported by deep domain capabilities, strategic platform acquisitions & partnerships.

We have also acquired platforms for data management & policy administration from banking and insurance leaders.

We leverage our intellectual property to provide solutions to:

- Increase Customer Service Satisfaction Levels through constant innovation of products and services across digital and physical banking touch points to maintain customer loyalty

- Address profitability through Automation of Front Office and Back Office Functions

- Partner with the Digital Journeys of banks in the long run by deploying digital channels such as Visual IVR ,Virtual Agent, Chat BOTs

THE FINANCIAL SERVICES SECTOR

Our research says:

The Investment Management and Wealth Management businesses are in the midst of dynamic changes due to pressure from both investors and regulators. In this scenario firms are looking a combination of service providers that will help them accomplish these changes and stay competitive and relevant.The Tech Mahindra BPS edge:

Business Process Services @ integrated Automation

Tech Mahindra’s Financial BPS practice leverages process, industry domain and technical knowledge to offer end-to-end solutions.

Our high end solutions are driven by significant investments in emerging trends such as Robotics Process Automation, business analytics, customer experience management and Managed services model-based operational transformation.

That’s what makes us a leader in providing Middle office and Back office services to Capital Market clients.

Clients across the Capital Markets value chain:

- Asset Managers

- Custodians

- Broker Dealers

- Wealth Managers

- Trust Companies

- Hedge Fund Administrators

- Benefit Administration Providers

- Transfer Agencies

Our Integrated Business Process Services:

- Client On-Boarding

- Trade Processing

- Clearing and Settlement

- Accounting

- Reconciliation

- Asset Servicing

- Client reporting

- Financial Reporting

- Regulatory Reporting

- Custody services & Performance

Our deep understanding of Asset Classes and Fund Types Supported include:

- Equities

- Bonds

- UITs

- Structured Products

- Rights & Warrants

- Collateralized Debts

- Options

- Commodities

- Direct Funds

- Closed-end Mutual Funds

- Fund of Funds

- Hedge Funds

- Mutual Funds

- REITs

- Pension Funds

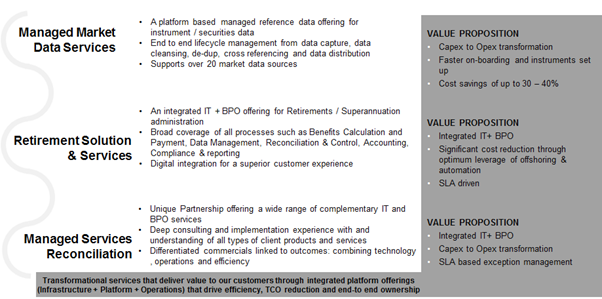

TechM BPS has envisaged specific solutions, offered through platform BPO and consulting, around the below themes to address the needs of our clients.

Investment Management

Tech Mahindra BPS has deep domain–specific Investment Management BPS capabilities. We service Investment Managers, Wealth Managers, Investment Banks, Private Banks and Pension Trusts across traditional and alternative investment classes for direct funds & fund of funds.

Areas and Expertise:

- Our Operations for investment management clients spread across Client onboarding, Transaction Management , Asset Servicing , Reference data Management , pricing performance attribution reporting, corporate actions, reconciliations and client reporting

- Asset Classes and Fund Types Supported include: Equities, Bonds, UITs, Structured Products, Rights & Warrants, Collateralized Debts, Options, Commodities, Direct Funds, Closed-end Mutual Funds, Fund of Funds, Hedge Funds, Mutual Funds, REITs and Pension Funds

Wealth Management

Our Wealth Management BPS operations supports back office services globally. Our service Financial Advisors support HNIs & Ultra HNIs, Family Trust, across a complex spectrum of Wealth Management operations. We have expertise in Retirement Solutions are and deliver Superannuation Administration to large clients as a platform based services.

Areas and Expertise:

- Our services consist of research and analytics, trade clearing and settlements, corporate actions, client onboarding, account transfers, performance measurement and attribution, client reporting and reconciliations functions

- We have significant experience across asset classes and products (Equities, Bonds, closed-end Mutual funds, Retirement Accounts, Alternative Investments, UITs, Structured Products, Rights & Warrants, Collateralized Debts, Options and Commodities).

- Corporate Action for Domestic and International markets on all functions covering Voluntary and Involuntary corporate action

- Internal training programs with Certifications for Superannuation delivery

Our Proven Expertise:

- Domain Experience: Strong Capital Markets Domain Expertise gained through managing large Financial Services operations

- Automation through Robotics: Strong Experience in RPA implementation to deliver value and savings beyond traditional models.

- Integrated Offerings: Integrated Operations and Technology strength leading to identification and implementation of Transformation opportunities

- Partnership Models: Flexible engagement models combined with Multi- Geo delivery models tailored to fit the business requirements